This compares with 75% for foreign exchange options, 25% for commodity options and 10% for stock options. Securities or other financial instruments mentioned in the material posted are not suitable for all investors. Before making any investment or trade, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice. If interest rates were to increase to 1.5% from 1%, a corporate bond that was purchased before the increase would appear to be a less attractive investment compared to the issuance priced at the higher rate.

- Traders can also speculate on changes in the interest rate, either via instruments like bonds or derivatives.

- “Making a market” means providing liquidity to clients who want to buy and sell.

- When inflation is high, central banks will set rates high to try to encourage saving and stem the rise in prices of goods and services.

- So, if rates rise then the corresponding interest rate market should also rise.

The Fed primarily controls interest rates, which they move higher in times of inflation and lower in times of recession. There’s no set repayment schedule with a margin loan—monthly interest charges accrue to your account, and you can repay the principal at your convenience. You should consult your tax advisor for details regarding your particular situation.

S10Y \ Small 10YR US Treasury Yield

Whereas, when trading interest rates, you get 100% exposure to any change made by central banks. By trading interest rates, you can hedge your risk on an interest-related asset like a bond or a loan. It’s also the opportunity https://forexhero.info/zulutrade-overview/ to trade a less conventional market and make the most of rate movement in either direction. As the lender of the national currency, the minimum interest rate in a country is decided by its central bank.

An interest rate option is often called a bond option and can be confused with binary options. However, interest rate options have different characteristics and payout structures than binary options. Some traders do move into managerial roles to reduce career volatility, and if they do that, their base salaries tend to increase. Automation has affected many parts of S&T, but rates products are more complex, and therefore harder to automate, so my desk hasn’t seen a huge impact yet. It is not necessarily a good idea to suggest something specific, such as using call or put options, because you’ll almost always be quizzed on how exactly it would work.

How Central Banks set interest rates

Each central bank’s board of governors controls the monetary policy of its country and the short-term rate of interest at which banks can borrow from one another. The central banks will raise rates in order to curb inflation and cut rates to inject money into the economy and encourage lending. In the U.S. and several other major economies, the central banks can set different interest rates for central bank loans and interbank loans. The interest rate of borrowing from the central bank is known as the discount rate, while the interest rate on interbank loans is called the federal funds rate. The federal funds rate is usually lower than the discount rate to encourage commercial banks to get loans from each other before applying for state loans. When the central bank is the lender, the loan is funded either from the national reserves or by printing money.

Our sales and trading analysis commentary allows you to stay up to date on macro and local developments, providing clarity on the potential impacts on your rates trading strategy. Additionally, as algorithmic trading becomes increasingly prevalent and mature, so too do our own purpose-built listed derivatives execution strategies. We offer levels of customization that enable you to execute your trade in line with your goals, capture price improvements, minimize market impact and, ultimately, achieve execution.

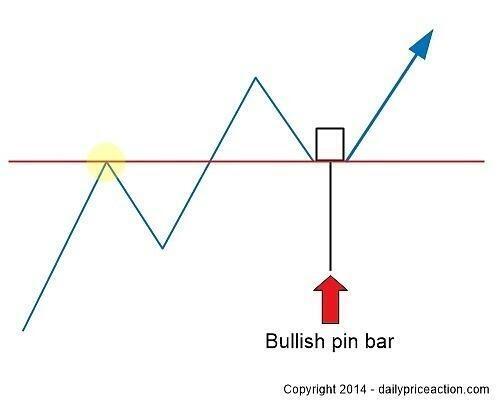

How to Express your Opinion with Interest Rate Trades

As the captain of the national economy, the central bank steers the country in economic storms. Interest rates are the sails of this economic boat, and the central banks are responsible for deciding where to set the sails as the economic climate changes. For example, in the 1970s the US Federal Reserve, in an attempt to reduce unemployment, “loosened” the supply of money. This resulted in a rate of inflation that averaged around 10% between 1974 and 1981.

As with other options, the holder does not have to wait until expiration to close the position. For an options seller, closing the position before expiration requires the purchase of an equivalent option with the same strike and expiration. However, there can be a gain or loss on unwinding the transaction, which is the difference between the premium originally paid for the option and the premium received from the unwinding contract. Now that you fully understand how they work and affect the economy put your knowledge into action.

Mutual Funds and Mutual Fund Investing – Fidelity Investments

Issuers of corporate debt may also decide to postpone or follow-through with a sale in the primary market depending on where interest rates are perceived to go. Although lower interest rates decrease an issuer’s borrowing costs, for example, if investors think they will likely increase at some later date, there may be less demand for the issuance. However, if investors think rates will remain low, and the yield offered remains attractive, there will likely be ample supply to select from. A corporate bond investor will therefore make a judgment about the direction of interest rates before making a purchase. Because actual interest rate movements do not always match expectations, swaps entail interest-rate risk. Put simply, a receiver (the counterparty receiving a fixed-rate payment stream) profits if interest rates fall and loses if interest rates rise.

What stocks are sensitive to interest rates?

Financial institutions, highly leveraged businesses, and companies that pay high dividends are all examples of interest sensitive stocks.